Insurance sector is an institution designed to minimize risks in human existence. Uncertainty is an unavoidable part of man’s life, despite all the planning that individuals and governments do. Insurance offers a partial solution for this insecurity about the future by ensuring financial solutions in case of unexpected eventualities like untimely death, property destruction, illness, accident etc. The insurer makes a profit by spreading the risk among the many people who buy the policy, all of whom are unlikely to face unexpected calamities. In India, even though the general penetration of insurance is not very high, the insurance sector is growing at a fast rate. This paper focuses on the various types of insurance services in India and their utility for the public along with Kerala’s insurance sector and its role in the state’s economy.

Keywords: Insurance, development, property destruction, policy

Introduction

Insurance is a deal by which the government or an insurance company enters into a bargain with a customer to provide monetary compensation for loss of property, illness, accident or death that he may suffer from, in return for a premium or a specific amount of money paid in advance as a part of that agreement. While taking an insurance policy, both the insured individual and the insuring company are taking risks. If no illness or accident or property damage befalls the insured individual, he will be losing the money he paid as premium. On the other hand, the insurance company loses money if too many people make claims so that the claim amount is much more than the amount the company had received as premium from all.

Insurance enterprises are an important part of a country’s financial service sector. Insurance companies pool the money that they receive from many insurers and use it to compensate for the loss that some of the insurers may suffer. For a risk to be insurable, it has to meet some criteria like being a definite loss and an accidental loss. For example, an insurance company will compensate a claim on a property only if the damage suffered was caused accidentally by fire or flood and not if it was the result of years of neglect and lack of maintenance.

Some of the biggest insurance companies of the world are Berkshire Hathaway with a market capitalization of $514.57 billion, Ping An of China with a market cap of $243.57 billion, and UnitedHealth with a market cap of $221.43 billion (Bajpai, 2019). However, an insurer should choose a company based not just on its size but its past record of prompt payment, its specialization in a specific type of insurance, premium rates, and its overall rating among its customers.

In India, the idea of insuring things started with the setting up of Bombay Mutual Life Assurance Society in 1870. Earlier, though there were insurance companies, they catered mainly to the needs of the ruling Europeans. Bombay Mutual Life Assurance Society started covering Indian lives also at normal rates. Later more insurance companies followed like Bharat Insurance Company in 1896, Cooperative Assurance (Lahore), National Insurance (Calcutta), and National Indian (Calcutta) all in 1906. Others like Hindustan Co-operative Insurance Company, the Indian Mercantile Insurance, General Assurance, and Swadeshi Life soon followed suit. After the country became free, on January 19th, 1956, life insurance in India was nationalised. On September 1st, 1956, the Life Insurance Corporation of India was born, created with the idea of spreading its services all over the country including the rural areas (https://www.licindia.in.)

By the year 2000, because of liberalization, many private insurance companies also entered the fray. This has increased the understanding about insurance significantly among Indian people. However, the growth of insurance sector has not been steady. In the financial year 2001-02, the penetration of life insurance was 2.59% and it increased to 4.60% by 2008-09.But by 2013-14, it declined to 2.60%. This means that the industry has still got a lot of growth potential.

The objectives of this study are,

1. To analyse the different types of insurance services in India

2. To identify the role of insurance sector in the development of Kerala

1. The Different Types of Insurance Services in India

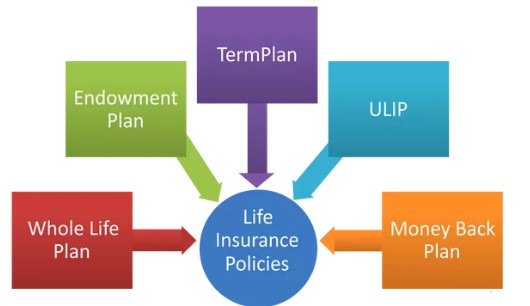

The specific types of insurance policies that customers are offered vary from country to country even though every country will have basic insurance policies like life insurance and vehicle insurance. Life insurance is very prevalent and popular among policy buyers because life is the most important asset that everyone hopes to get compensated for. Life insurance is not just a protection but also a form of investment because the insured will receive a certain sum at the expiry of a specific period if not after death.

Property insurance provides protection against certain risks to people’s properties. Fire insurance, crop insurance, aviation insurance, theft insurance, and marine insurance are some of the forms of property insurance. Marine insurance provides protection against damages caused by accidental collision of a ship with a rock, another vessel, damage caused by pirates, non-payment of freight etc. Marine insurance itself has different types of coverage like freight insurance, hull insurance, and cargo insurance.

Gap insurance – Guaranteed Auto Protection insurance - is a type of auto insurance that car owners can purchase to protect themselves against losses that can arise when the compensation received does not fully cover the sum owed by the insured to the vehicle's financing or lease agreement. Liability insurance is a policy offered to professionals, business owners etc. to cover the cost of compensation claims that may arise from their employees, customers, or clients as a result of injury, negligence etc.

The insurance sector in India has 57 companies, of which 24 are life insurance companies and 33 are non-life insurers. Among the former, Life Insurance Corporation (LIC) is the only public sector company. Among the latter, there are six public sector companies. There is a single national re-insurer, which is General Insurance Corporation of India (GIC Re)(www.ibef.org).India’sinsurance sector can be broadly divided into two, namely life insurance and general insurance as shown below. However, the list below is not an exhaustive one since the many insurance companies in India together offer a fairly wide range of policies.

Types of Insurance

Life Insurance General Insurance

Term-life Money-back policy Unit-linked Insurance Plan Pension plans Motor Insurance Home Insurance Health Insurance Fire Insurance (Source: https://www.acko.com/articles/general-info/types-of-insurance/)

Term insurance is a life insurance policy which covers the insured person for a specific time period. If the death of the policy holder takes place during that specified period, the agreed-upon amount is paid to the beneficiary of the policy. If the insured individual continues to be alive till the end of the period, no benefits will be payable to anyone. However, some of the insurance companies offer some additional benefits along with a term life policy. The most positive aspect of term insurance is that its premiums are generally low and the amount offered as death benefit is good in comparison.

Money-back policy is also a type of term insurance which offers life coverage during a specific term and gives back money at fixed intervals during the tenure of the plan. Upon the maturity of the plan, the remaining assured amount is paid to the policy holder with some bonuses. But in the case of the death of the insured individual during the tenure of the policy, the full assured sum is paid, regardless of the money-back benefits that the individual had already received. The attraction of the money-back policy is that because of the amount received at regular intervals, it is also an investment plan besides being a security in the eventuality of death.

As different from a term-life policy, a whole life policy continues throughout the life-time of the insured individual. He can take a loan against it or withdraw it when he wants. It matures at the time of the insured individual’s death or when he turns 100, whichever is earlier. When a policy matures, its money value becomes equivalent to the death benefit. A whole life policy can be purchased against a once-in-a-lifetime payment or through monthly or yearly payments.

The policy holder can decide who will be the beneficiary of his policy. The Married Women's Property Act, 1874 (MWPA) gives a man the power to make his wife or children or both the beneficiaries to the exclusion of other family members, people from whom he has borrowed money or business associates. However, once the policy is issued, the beneficiaries cannot be changed. So even if the policy holder later had a fallout with his son or had to divorce his wife, they will continue to be his beneficiaries.

In a unit-linked whole life policy, the funds will be used for the payment of the assured amount and the rest of it will go into an investment fund. The insurer periodically reviews this policy and if the investment fund where the remainder amount is invested is not performing well, would advise the policy holder to increase his contribution or reduce the sum assured (https://www.bankbazaar.com.).

Pension plans, which are also called retirement plans, are policies that are good investment options. Through these, an individual can let his savings accrue over a period of time so that when he retires he can be assured of a regular income. A pension policy gives an individual financial security at a time of life when his earning capacity is low. LIC’s Jeevan Nidhi and Jeevan Akshay 6, HDFC’s Life Click2Retire and Life – Assured Pension, State Bank of India’s Life Saral Pension, ICICI’s Pru – Easy Retirement, Birla’s Sun Life Empower Pension etc. are some of India’s top-rated pension plans.

Among the general insurance plans, motor insurance is the most mandatory in India. Depending upon the type of vehicle insurance an individual has got, the insurance cover will pay for the repair of his car if it gets into an accident, will pay for the damages caused to another person’s property by the policy holder’s car (Third Party Liability), will pay for the insured person’s hospitalization caused by the vehicle accident, and even pay the family in the case of the vehicle owner’s death in the accident.

Home insurance policies do have some standard coverage but it is a policy that can be customized to suit individual needs. It can be availed to repair a place, or replace household goods if they get lost in theft, damaged in a fire or accident, or get destroyed in some natural calamities though not all the problems created by nature. However, since these policies are open to a fairly good level of customization, many companies allow the customer to buy additional policies for natural disasters like flood or earthquake. There is also a personal liability coverage that can be added to Homeowners Insurance Policy. It will help pay medical bills if a guest is injured inside the policy-holder’s home or on his property.

In India, health insurance generally covers expenses involved in hospitalization and treatment in the hospital. Outpatient expenses are rarely, if at all, covered by health insurance schemes. In some companies, employers provide insurance policies to their employees. To supplement such policies, some insurance companies offer what are called top-up policies which will augment the insurance cover. Then there are family insurance plans that cover the whole family in one plan. Other health plan options offered by different companies are disease-specific plans, pro-active plans, senior citizens insurance, pre-existing disease plans etc. “Healthcare market in India is expected to reach US$ 372 billion by 2022, driven by rising incomes, greater health awareness, lifestyle diseases and increasing access to insurance” (www.ibef.org).

Finally though all homeowners can buy a fire insurance policy, fire insurance buyers are mainly building owners, shopkeepers, godown keepers, theatre owners, educational institutions, banks, hospitals, hotels, factories, and industrial entities.

“The life insurance industry in India is one of the biggest life insurance industries in the world, with over 360 million policies, and expected to grow at a rate of about 15% for the next five years, with increased life insurance penetration levels to at least 5% by 2020.1 In 2013, India ranked eleventh among eighty-eight countries in the life insurance business, with a share of 2.1%, and ranked twenty-first in the global non-life insurance market with a share of 0.7%; it is the twentieth largest insurance market in the world in terms of premium volume” (Shahnawaz, 2018).

2. The Role of Insurance Sector in the Development in Kerala

Kerala is one of the smaller states in India, being 22nd in size of its 29 states. However, its economy is 11th in the country among the states, on the basis of gross state domestic product (GSDP). According to the report of Kerala State Planning Board, the state’s per capita GDP was Rs.140,107 in 2016-2017. At 0.784 (2017 report) Kerala’s Human Development Index (HDI) is the highest in India (https://en.wikipedia.org).All these have to be seen as conducive to the growth of insurance sector.

Kerala’s economy thrives mainly from the remittances that the state gets from abroad, from its NRIs. Its economy is service-sector dominated where “throughout the post-independence period, the service sector retained its prominence both in income and employment generation”(chapter III Disentangling service sector growth in Kerala). Since Kerala is a coastal state, its economy is influenced by marine trade as well. Kerala’s infrastructure development is also considered satisfactory, and “her experiences in social infrastructure development rank her one among many developed countries” (Pillai, 2008).

The business of insurance started in Kerala when State Insurance Department came into being in the former State of Travancore in 1896 (Finance Department, Government of Kerala). In 1979 it was declared as a commercial department, handling both life insurance and general insurance business. It is registered with IRDA and has the power to underwrite “General Insurance of any subject in which State Government has substantial financial interest”. Life Insurance with the State Insurance Department was made compulsory for the State Government employees with effect from 19.8.1976 (http://www.insurance.kerala.gov.in).

After the formation of Life Insurance Corporation of India in 1956, it became a major player in Kerala also. As people’s income increased, more and more of them became conscious of the need to insure things. In the post-liberalization era, when private companies were allowed to enter the insurance sector, this trend increased. Since Kerala’s banking infrastructure was good, it gave a fillip to the insurance sector, which has many parallels with banking industry since both promote ideas of saving and investment.

In the financial year 2006-07, the number of policies underwritten in Kerala was 20,38,410. Later, in 2007-08, this number increased to 26,67,048. But from the year 2008-09, the buying of insurance policies showed a downward trend, as was the general trend in the country. As a result, by 2012-13, the number of policies taken reduced to19,23,739, less than even the 2006-07 level.

Life Insurance Corporation of India continued to be the major player in Kerala’s insurance sector. In 2006-07, 77.26% of the new life insurance policies issued were that of LIC and only the rest (22.74%) belonged to private companies. Among the private players, Bajaj Alianz’s share was 7.61%, ICICI Prudential’s was 5.49%, and the rest had much less. By 2007-08, the share of private companies increased a bit to 25.50%and Bajaj Alianz (6.85%) and ICICI Prudential (6.69%) continued to be the main players in that section. SBI Life, Tata AIA, and Kotak Mahindra are some of the other private insurers active in Kerala. Their market shares in 2007-08 were 2.89%, 1.15%, and 1.01% respectively.

However, the role of LIC in Kerala’s economy remains unchallenged. In 2012-2013, 89.00% of the policies sold in Kerala were that of LIC of India. Among the rest, the share of even SBI Life, which had the leading market share, was only 2.069%.

Insurance density and insurance penetration are indicators of the development of the insurance sector in a country’s economy. Insurance density is the ratio between the total premium collected and the total population of a given area. It is generally expressed in currency units. Insurance penetration is the ratio between the total premium and the total GDP of a given area’s economy and is expressed as a percentage.

In the year 2006-07, Delhi’s insurance penetration was 2.86% of its Gross State Domestic Product. This was the highest of all Indian states. With 6.95% penetration, Chandigarh was at the top among union territories. Among states, Himachal Pradesh was second with 2.68% and Kerala third with 2.54%. The country’s average during that financial year was 1.56%. In 2007-08, Kerala’s percentage became 3.62% and it was the highest penetration recorded in the country. However, by 2012-13, the country’s penetration average came down to 0.66% and Kerala’s became 0.79% and its rank became 9th.

However, much more remains to be done to increase insurance awareness and penetration in Kerala. In the year 2018, Kerala had a brush with massive floods. After the waters receded and people started rebuilding their lives, it became evident that very few people had insurance. It meant that the government would have to bear much of the expenses involved in resettling those who had lost homes and property. Or the affected person will have to do it himself. Only about 5% of the damage was seen to be covered by insurance in Kerala (Kelkar, 2018). People of Kerala do not appear to be too keen on getting themselves or their properties insured.

Conclusion

Insurance sector is a comparatively young business sector that has not penetrated fully into both rural and urban areas. In India, the government-controlled Life Insurance Corporation of India is the main organization on which people rely for their insurance needs. People are more interested in insuring their lives than anything else and these life insurance policies are themselves divided into different types like term-life, money-back policy, unit-linked plan, pension plan etc. These plans continue to be more popular among the public than general insurance options like insuring against fire hazards, illnesses, vehicle accident, or property damage.

The state of Kerala, despite its small size, has shown good interest in developing the insurance sector. This is probably because of the special nature of its economy which is service sector-dominated and depends to a big extent on foreign remittances. In Kerala too, LIC is the major player, even though private insurance companies are also making inroads. However, insurance penetration is not sufficient even in Kerala. A big proof for this was the devastation caused by torrential rains and resultant floods of 2018. Only a small percentage of the property that was damaged was insured. Further, insurance penetration, though it is increasing, is also not showing a uniform upward trend.

References

1. Bajpai, P.(2020,February 5). World’s Top 10 Insurance Companies, Investopedia, retrieved from https://www.investopedia.com/articles/personalfinance/010715/worlds-top-10-insurance-companies.asp.

2. Kelkar, N. (2018, August 28). Life’s shock absorbers, The Week, Magazine, Availed at https://www.theweek.in/thewallet/cover/2018/09/28/lifes-shock-absorbers.html

3. Pillai N.,& Vijayamohanan., (2008). "Infrastructure, Growth And Human Development In Kerala," MPRA Paper 7017, University Library of Munich, Germany

4. Sheikh,S. (2018). Performance Analysis of Indian Life Insurance Companies using the Analytic Hierarchy Process, International Journal of Scientific and Research Publications, Volume 8, p. 270.